Our Partnerships and Business Development Lead, Juan Marcano, writes for Global Parametrics as part of the UK Department for International Trade‘s Business of Resilience thought leadership series. The Business of Resilience Campaign is promoting the UK’s capabilities in resilience insurance and associated services covering climate and natural disasters, pandemics, cyber and other related supply chain risks.

Climate change is increasing natural hazards and extreme weather risks globally. But as these risks grow, so have the number of innovations to mitigate them. Insurance – often seen as the dull side of finance – now has a key role in providing solutions to the climate crisis.

Currently, many businesses and individuals lack formal risk transfer in areas which suffer from natural hazard and extreme weather risk. This protection gap poses a challenge, but also an opportunity for re/-insurance players to strengthen global economic resilience and to grow into these emerging markets. Harnessing innovations in technology and risk management has only increased the ability to develop such solutions and cover previously uninsurable risk.

The experience in Mexico

The Mexico Reef Protection Programme (MRPP), launched in 2018, was seen as a first step in changing how we value our natural assets, and the place of the insurance sector in protecting and restoring natural landscapes.

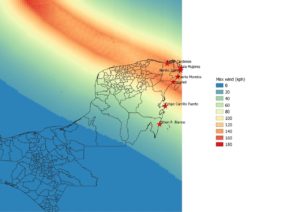

The programme protects a large section of the Mesoamerican reef, releasing payouts in the event of a tropical storm to be used for restoration of the reef itself.

Providing cover for the reef not only protects the reef, but has knock-on positive effects to the communities on its shore. Coral reefs act like natural sea walls; shielding nearby buildings from the devastating impacts of tropical storm surge. Preserving the reef also retains the ecosystem (beaches, dunes, marine environment) which are essential for tourism income in the area. The programme is a prominent example of a nature-based solution; conserving and protecting nature to the benefit of society and human well-being.

The Reef Programme is a parametric solution; providing a pre-agreed payment based on the probability of the pre-identified event. These methods of coverage take away the need for valuing the asset itself, meaning the policy is triggered not by financial losses, but when a pre-identified event occurs, which in this case is when wind speeds exceed 100 knots in a pre-defined area.

Parametric solutions provide an ordered and managed method to inject funds from global reinsurance and capital markets into areas impacted by natural catastrophe risk. This market solution relies on private capital to finance a gap which would otherwise be shouldered by local government and communities.

How it all works

For the MRPP, funds are paid out following a parametric trigger for a tropical storm in an area of the Mesoamerican reef. Leveraging parametrics for the programme ensures a rapid and objective payout, and transparency on payment conditions. Through the latest technology in scientific risk hazard modelling, the risk of tropical storm in the area can be more easily understood, allowing local government and affected communities to consider further pre-disaster risk assessment management and response planning.

Integrating the understanding of risk on the ground as perceived by the end user creates a better placed product. By engaging with the local government of Quintana Roo, the MRPP helps to achieve the sustainability of the programme in future, promoting knowledge sharing of the technology and infrastructure behind the programme and the creation of an inclusive and transparent system for premium collection.

Innovative programs such as the MRPP, are often initiated and subsidized via donor agencies or corporate social responsibility initiatives, which, although useful for establishing a programme’s infrastructure and mechanisms, are not focused on sustainable methods to continue and expand once the duration of the programme is complete.

By engaging the local financial sector, the state of Quintana Roo was able to renew this programme without subsidies, even during the Covid-19 Crisis. The renewal was conducted through Mexican insurer Banorte, supported by Global Parametrics and the Natural Disaster Fund – a public private partnership designated to mitigate the challenges in natural disaster resilience for low-and middle-income countries with participation from the UK and German governments and global reinsurer Hannover Re. The local commitment and brings understanding of such a programme and its associated products to the local market, thereby increasing capacity at the local level for future renewals and scale.

The local benefits

Following Hurricane Delta on 7th October 2020, the reinsurance policy paid out 40% of the total limit within 14 days. The final payment was used to fund work dedicated to the restoration of the reef. Given these successes, the local government of Quintana Roo is looking to expand the scope of the programme to include beaches and dunes, and to scale up the geographic coverage.

As the risk of extreme weather and natural hazards grow, so does the opportunity for firms to take part in risk management solutions. Nature based solutions are an important tool to manage the effects of climate change. Risk transfer can both protect the natural and human element of these programmes and mitigate the financial impact of natural events. Linking the two creates sustainable interventions that build local resilience and capacity to help mitigate the impact of extreme weather events.

To learn more about the insurance industry and the positive impact it has in climate resilience join the Business of Resilience Conference 2021