To celebrate the 5-year renewal of our flagship programme with VisionFund, the African, Asian and Americas Resilience in Disaster Insurance Scheme (ARDIS), we sat down with Kevin Huttly, ARDIS Director, to discuss the scheme, reflect on its successes and outline future plans.

It’s the five-year renewal of the ARDIS, could you explain the scheme and what it does?

ARDIS covers VisionFund’s microfinance institutions (MFIs) across 27 countries. Established in 2018, ARDIS is a financial tool for promoting recovery lending and active risk management for our network of MFIs. It provides access to capital via climate indexed derivative and contingent credit contracts when a disaster occurs. VisionFund uses the ARDIS programme to support recovery lending to its client base, many of whom are women in the agricultural sector, where loans typically range from $70 to $300, in the event of a natural hazard or extreme weather, including earthquakes, tropical cyclones, droughts and excess rain. ARDIS buys the derivative contract from the Natural Disaster Fund, managed by the Global Parametrics team. Global Parametrics creates the parametric indices which back the risk transfer contract for ARDIS; if they are triggered during specific events there are payouts which are then distributed by ARDIS back into the institutions as capital.

How do you think that the ARDIS programme is innovative and unique at helping protect against the impact of natural hazards and extreme weather?

ARDIS has been referred to as the world’s largest non-governmental climate ‘insurance’ programme. However, the scheme is innovative and unique because it does not function like traditional indemnity insurance. Instead, ARDIS is a blended scheme that uses different financial tools to help people rebuild after a natural hazard or extreme weather event. This allows MFIs to continue lending to them, when often credit is scarce following the uncertainty of the event’s impact and thereby, helping them to get back on their feet faster. It would be very difficult to pre-emptively assess what a farmer’s exposure is to these risks, so instead, Global Parametrics creates indices for perils, which pay out when triggered by an event, eliminating assessment of loss time and costs and permitting immediate access to payouts and benefits. These indices use global, publicly available datasets, allowing for an objective and transparent measurement of risk.

How far reaching is the ARDIS programme?

Originally, when the scheme was first established in 2018, it covered 6 countries in Africa and Asia. This has grown over time with numerous successful renewals, now operating globally in all 27 of VisionFund’s countries as of 2022, 11 in Africa, 7 in Latin America, 6 in Asia and 3 in Middle Eastern and Eastern European countries.

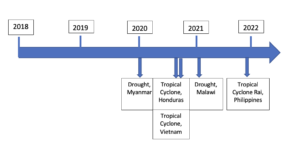

Growth in geographic reach 2018-2022

What impact has the ARDIS programme had over the last five years?

The ARDIS scheme has made a significant impact in locations such as Honduras, the Philippines, Myanmar, Eastern and Southern Africa, where the scheme operates for a range of perils including flood, drought, earthquake, and tropical cyclone windstorm. We have seen evidence that most of the loans, in these places, have enabled people to get back on their feet, mitigating negative coping mechanisms, and being able to pay back their old and new loans in the wake of a natural hazard or extreme weather event.

In the last 3 years, the Covid-19 pandemic has been a significant challenge for VisionFund overshadowing ARDIS and its impact. At times many of our institutions have been restricted in their loan making abilities by lockdowns and have not been able to go into the field. This has meant restriction on recovery lending even when there has been both capital payouts and credit entitlements. However, more lately, institutions have been able to go back into the markets and start lending again, using recovery loans. Overall, I think Covid-19 has helped the understanding within our organisation of the value of recovery lending and of insuring against disaster. At an MFI level, our institutions now understand recovery lending a lot better, as they have been performing it for Covid-19.

In terms of pay-outs, ARDIS has made 5 payments under the derivatives for flood, drought and tropical cyclone windstorm.

:

What is the future of the ARDIS programme, where else do you hope to make an impact with the scheme?

We are looking to build on the successes of ARDIS, to forge a new partnership with Global Parametrics going forward. We want to create ‘ARDIS 2.0’ which would act as a consultant advisor to other microfinance organisations, assessing their risk to natural perils and advising on the best programme structure and how to efficiently access products based on their risk. The partnership would not only focus on the insurance aspects, but also endeavour to educate people on recovery lending, how it works and its benefits, aiming to change mind-sets about how to best to protect vulnerable individuals and communities from natural hazard disasters.

For more information on ARDIS and its impact, please go to the VisionFund website: https://www.visionfund.org/our-focus/insurance/ardis